Calculate Your Mortgage Through The Latest Mortgage Calculator

When it comes to mortgages, you want to find a balance between borrowing enough to make your mortgage payments while not going overboard. This is where our mortgage affordability calculator may help.

Most people's most important personal investment is purchasing a home with a mortgage. Not only does the amount you can borrow depend on how much a bank is prepared to lend you, but it also depends on a number of other factors. Along with your financial circumstances, your personal tastes and priorities must be considered.

How Much Mortgage Can I Afford On My Salary?

Whether you're a first-time homeowner or a seasoned real estate investor, buying a property requires a lot of paperwork and patience. If you want to be sure you're making the right financial decision, you should do the math before you have your heart set on a certain property.

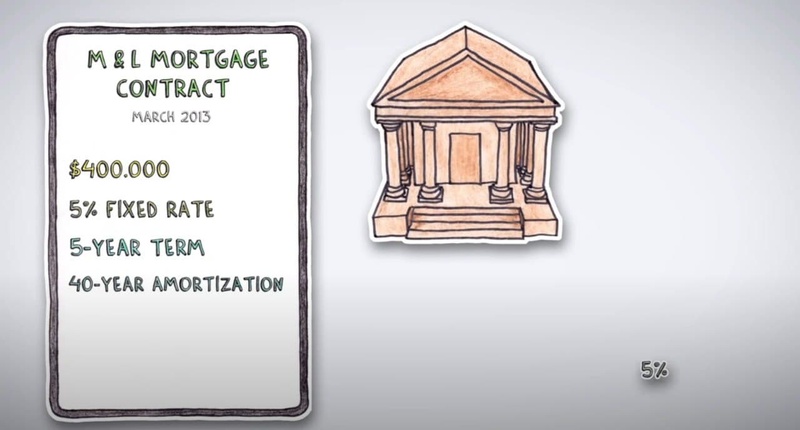

When you get pre-approved for a mortgage, the lender will tell you how much of a loan you may be eligible for. While your salary and credit score are obvious considerations, lenders look at your whole financial picture when evaluating the amount of money you may borrow.

At the same time, you should carefully assess your money to see how much you can comfortably spend. Financial advisors provide some suggestions, but it is ultimately up to you to decide how comfortable you are with debt.

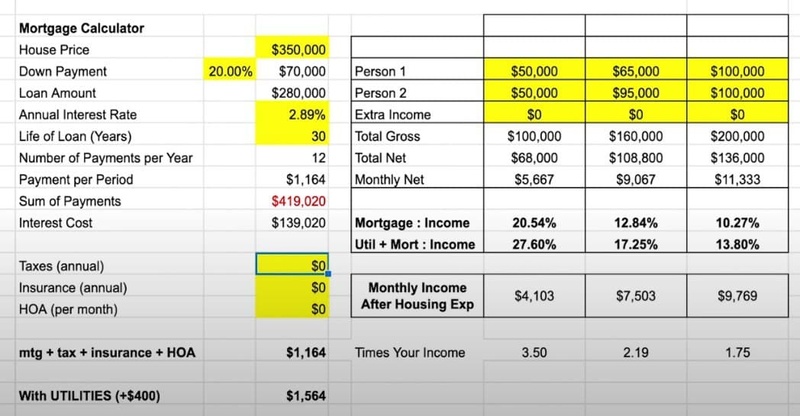

Most would-be homeowners can comfortably finance a home that costs two to two and a half times their annual gross income. A $100,000-per-year income can only afford a $200,000 to $250,000 mortgage, according to this assessment. However, this estimate should only be used as a rough guideline.

Finally, when looking for a property, you must consider a variety of additional factors. To begin, you need find out how much your lender feels you can pay (and how it arrived at that estimation). Second, perform some personal contemplation to identify what type of home you are willing to live in for an extended length of time, as well as what other types of consumption you are willing to renounce to pay for your home.

While real estate has long been thought to be a safe long-term investment, recessions and other disasters (such as the COVID-19 outbreak) may put that belief to the test, forcing potential homeowners to reassess their purchase.

It's important to remember that just because you qualify for a specific amount doesn't mean you can afford the monthly payments. You should consider your current status as well as your future financial needs and goals before going for this option.

The Fundamentals of the Mortgage Process | MGIC Training Webinar

Three Times Your Salary Rule

The ideal mortgage is one that is no more than three times your annual salary.

If your annual income is $40,000, you should think twice before taking out a mortgage that surpasses $120,000. If you have a spouse and your combined salary with them is $80,000, you may easily increase your loan to $240,000.

That's not to imply you should always go for the most costly mortgage available. If you pick anything less than your limit, you'll have more flexibility room to put money into a savings account or pay for other needs like home upgrades.

The "three times your income" rule may not be practicable for people who live in high-cost-of-living areas. If you think you'll need a bigger mortgage to buy a property, be sure you're in good financial shape in other aspects of your life. To compensate for the fact that your budget will be squeezed, it's vital to have a significant emergency fund set up. You should also set aside enough money for retirement, as well as a separate fund to cover your moving and closing costs.

Larger mortgages, on the other hand, are not always the best option. If your mortgage represents too much of your income, a lender may apply higher interest rates and other penalties to compensate for the greater risk of default.

The 28/36% Rule

Most financial experts feel that people should spend no more than 28% of their gross monthly income on housing and 36% on overall debt, which includes housing and education loans, auto payments, and credit card payments. The 28/36 percent rule is a tried-and-true home affordability guideline that establishes how much you may spend each month on your property.

To figure out how much 28 percent of your salary is, simply multiply your monthly income by 28. For example, if your monthly income is $8,000, your calculation should be: 8,000 multiplied by 28 equals 224,000. Divide the sum by 100 to get 2,240. 224,000 x 100 = 2,240.

Depending on where you live and how much money you make, your annual wage may be enough to cover your mortgage or it may fall short. Knowing how much you can afford can help you make better financial decisions. Even if you can find a lender willing to take on the loan, the last thing you want to do is lock yourself into a 30-year mortgage that is too expensive for your budget.

What Factors Do Lenders Consider When Choosing Whether Or Not To Finance A Mortgage?

While each mortgage lender has their own set of affordability rules, the following elements will always be used to determine your ability to buy a home, as well as the amount and terms of the loan you'll be awarded.

Gross Income

Before taxes and other duties are subtracted, this is the amount of money a potential homeowner makes. Your basic salary, including any bonus income, including part-time wages, self-employment earnings, social security benefits, disability, alimony, and child support is considered as your gross income.

Debt-To-Income Ratio (DTI)

The debt-to-income ratio, or DTI, compares your monthly debt to your monthly income. A individual with a high debt-to-income ratio, and vice versa, will have a higher DTI. This is a key statistic since it reflects your ability to take on further debt. The higher your debt-to-income ratio, the more difficult it will be to obtain a mortgage, much alone one with a low interest rate. Many lenders may refuse to lend to someone who has a debt-to-income ratio of more than 43%.

Debts include credit card obligations, child support, and other outstanding liabilities (auto, student, etc.).

In other words, if you pay $2,000 per month in debt services and earn $4,000 per month, your debt-to-income ratio is 50%, implying that you use half of your monthly income to pay off your debt.

A debt-to-income ratio of 50%, on the other hand, will not allow you to purchase your ideal home. Your debt-to-income ratio (DTI) should not exceed 43 percent of your gross income, according to most lenders. To calculate your maximum monthly debt based on this ratio, multiply your gross income by 0.43 and divide by 12.

Only debt obligations, not monthly expenses, are considered in your DTI. As a consequence, you won't have to pay for things like gym subscriptions, or health insurance.

Subtract your total monthly debt from your gross monthly income (before taxes and deductions).

Add up your monthly debt: For instance, $1200 for rent, $200 for auto payments, $150 for school loans, and $85 for credit card instalments = $1,635.

Divide your debt ($1,635) from your monthly gross income ($4,000). Your DTI is 41 percent rounded up. Your DTI reduces to 39 percent if you eliminate the $85 monthly credit card bill, for example.

Front-End Ratio

Gross income has a significant impact on the front-end ratio, often known as the mortgage-to-income ratio. This is the percentage of your annual gross income that you may put towards paying down your mortgage each month. The four components of your monthly mortgage payment are known as PITI: principal, interest, taxes, and insurance, which covers both property insurance and private mortgage insurance if your loan requires it.

According to a good rule of thumb, your front-end ratio based on PITI should not exceed 28 percent of your total revenue. Many lenders, on the other hand, enable borrowers to borrow more than 30% of their income, and some even allow them to borrow more than 40%.

Your Credit Score

Debt is the opposite side of the affordability equation, if income is one side. A mechanism for measuring a potential homebuyer's risk level has been created by mortgage lenders. The process varies, but it is typically dependent on the credit score of the applicant.

Applicants with a low credit score might expect to pay a higher interest rate, also known as an annual percentage rate (APR), on their loan. If you want to buy a house soon, pay attention to your credit reports. Make sure you read your reports carefully. It will take time to fix any errors, and you don't want to miss out on your dream home due to anything that isn't your fault.

How To Determine The Amount Of A Down Payment?

A lender may tell you that you can afford a huge estate, but are you sure? Remember that the lender's criteria are mostly dependent on your gross income and prior debts. The problem with calculating gross revenue is simple: You're planning to spend up to 30% of your salary on your budget, but what about taxes, FICA deductions, and health insurance premiums? Even if you get a tax refund, it won't help you right now, and how much will you receive?

As a result, some financial experts say that thinking in terms of net income is more logical, and that your mortgage payment should not exceed 25% of your net income. Otherwise, you risk becoming "house poor," even if you can manage to pay your mortgage on a monthly basis.

Paying for and maintaining your home may eat up such a large amount of your salary, much above the nominal front-end ratio, that you won't have enough money left over to handle other discretionary expenses, debts, or even save for retirement or a rainy day. Homelessness is mostly a personal choice; just because you've been approved for a mortgage doesn't mean you'll be able to make the payments.

How Lenders Make Their Decisions

When assessing a homebuyer's affordability, the mortgage lender evaluates a number of factors, but they all boil down to income, debt, assets, and commitments. A lender is interested in how much money an application generates, how many requests it receives, and the possibility of both in the future; in other words, everything that may jeopardize its ability to be repaid. Income, down payment, and monthly expenses are frequently utilized to qualify for financing, and credit history and score have an impact on the loan's interest rate.

Costs Beyond The Mortgage

While the mortgage is without a doubt the most major financial requirement of home ownership, there are several other expenses, some of which continue even after the mortgage is paid off. Smart consumers should keep the following points in mind:

Insurance For Your Home

To protect their home and valuables from natural and man-made disasters such as tornadoes and theft, every homeowner needs house insurance. You'll need to find out what sort of insurance you'll need if you're purchasing a property. Most mortgage companies will not let you purchase a property unless you have full-coverage home insurance. In fact, before granting your loan, your mortgage lender may need proof of homeowner's insurance.

According to the most recent statistics available as of early 2021, the average premium for the most common type of house insurance in the United States was around $1,200.9 in 2018. The cost, however, varies depending on the type of insurance you require and the state in which you reside.

Taxes On Real Estate

If you buy a house, you can expect to pay property taxes, and knowing how much you'll owe is an important part of a homebuyer's budget. The city, township, or county determines your property tax, which is based on the size of your home and land, as well as other considerations such as local real estate conditions and the market.

The effective average rate for property taxes in the United States is 1.1 percent of the assessed value of the residence, according to the Tax Foundation. Property taxes vary by state, with some having lower rates than others. For example, in New York, the average is 1.4 percent, whereas in Oklahoma, it is 0.88 percent. You will still be liable for paying property taxes even if your mortgage is paid off in full.

Utilities

Heat, electricity, water, sewage, rubbish collection, cable television, and telephone services are all costly. These expenses aren't accounted for in the front-end or back-end ratios. They are, nonetheless, unavoidable for the vast majority of homeowners.

Maintenance

Even if you build a new house, it will not survive indefinitely, and neither will the expensive major appliances such as stoves, dishwashers, and refrigerators. Roof, furnace, driveway, carpet, and even wall paint are all impacted. You may find yourself in a difficult situation if your finances haven't improved by the time your property requires big repairs.

Fees Charged By The Association

Monthly or yearly association fees are charged in many condos and cooperatives, as well as gated communities and planned communities. These expenses might range from $100 per year to several hundred dollars each month. In certain areas, lawn care, snow removal, a community pool, and other services are offered.

Some contributions are used only to fund the community's administrative costs. It's important to keep in mind that, while more lenders are include association fees in the front-end ratio, these expenses are projected to climb in the future.

Decor And Furniture

Before buying a new house, consider the number of rooms that will need to be furnished and the number of windows that will need to be covered.

8 Easy Steps to Understand the Mortgage Process!

Second Mortgage Calculator: How Much Can I Borrow

Many factors influence the amount you may borrow for a mortgage, including your salary, bill payments, and any other regular commitments, such as student loans or credit card bills.

Many factors influence the amount you may borrow for a mortgage, including your salary, bill payments, and any other regular commitments, such as student loans or credit card bills.

These criteria are taken into account when a mortgage lender evaluates how much they might be able to provide you for a mortgage. Interest rates are another consideration, and most mortgage lenders will guarantee that you will be able to repay the loan even if rates rise.

Because it is used to acquire a second property, a second house mortgage differs from a remortgage or a second charge mortgage. Second mortgages are for those who desire to acquire a second home as a rental property or as a buy-to-let venture.

They may also be nearing the end of their first mortgage payments and confident in their ability to obtain a second loan. It functions similarly to a first mortgage, but with more severe affordability standards, as paying off a second mortgage may be a significant financial strain.

So, if you're searching for a mortgage for a second home, make sure your finances are in order before applying. A second home mortgage calculator may help you figure out how much you want to borrow and how much you'll have to pay each month.

How Does A Second Mortgage Work

Although your home's equity is a valuable asset, unlike more liquid assets such as cash, it is typically not accessible.

A second mortgage, on the other hand, allows you to use the equity in your property. That money is no longer tied up in your residence, but is now available for immediate use. This might be advantageous or disadvantageous, depending on your financial goals.

The particular requirements for getting accepted for a second mortgage will be determined by the lender you work with. The most basic need is that you own your home and have some equity in it.

Your lender will likely only allow you to take out a portion of this equity, depending on the value of your property and the outstanding loan debt on your first mortgage, so that you maintain a certain level of equity in your home (typically 20 percent of its value).

To get approved for a second mortgage, you'll almost definitely need a credit score of at least 620, but individual lender requirements may be higher. Also, keep in mind that higher ratings indicate higher rates. A debt-to-income ratio (DTI) of less than 43% is almost probably required.

How Does Home Equity Work

Before we go into what second mortgages are and who they're for, let's learn a bit more about home equity. The amount of money you may get through a second mortgage is determined by the amount of equity you have in your property.

A lien is placed on your property until your mortgage debt is paid off in full. Your lender has the ability to repossess your home if you default on your mortgage loan before it is paid off. When you pay down your main loan amount over time, the portion of your loan that you have paid off is referred to as equity.

Finding out how much equity you have in your home is straightforward. Subtract the amount you've paid toward the main balance of your mortgage from the total amount owed.

For example, if you bought a $200,000 property and paid off $60,000 in equity, including your down payment, you now have $60,000 in equity in your home. The amount of interest you pay has no effect on your home equity.

There are other ways to increase the value of your property. If you reside in a hot real estate market or make modifications to it, the value of your home will rise. This increases your equity without necessitating further payments. On the other hand, if the value of your home drops and you enter a buyer's market, you may lose equity.

What Is A Second Charge Mortgage, And How Does It Work

Some people thinking about buying a second house could choose a second charge mortgage, which is also known as a second mortgage, despite the fact that these are two separate types of loans.

A second charge mortgage is a secured loan secured against your property that allows you to use the equity to help fund a second mortgage to buy a new home.

The affordability requirements for a second charge mortgage or secured loan are less strict because your present home is used as collateral. On the other hand, a second mortgage is nothing more than a new loan.

Types Of Second Mortgages

Second mortgages are divided into two types: home equity loans and home equity lines of credit.

Home Equity Loan

A home equity loan works similarly to a cash-out refinance in that it allows you to take a lump-sum payment from your equity. When you take out a home equity loan, your second mortgage provider pays you a percentage of your equity in cash.

In exchange, the lender acquires a second lien on your property. The loan is repaid in monthly instalments with interest, just like your first mortgage. The bulk of home equity loans have terms of 5 to 30 years, meaning you must return them within that time frame.

When you get a home equity loan, you get a lump sum of money that you pay back in monthly amounts over time. You may be a good candidate for a home equity loan if you know exactly how much money you need to borrow and like the idea of obtaining all of your money at once.

Home Equity Line Of Credit

A HELOC works in much the same way as a credit card in that you are given a credit limit and can borrow as much or as little as you like. If you desire the flexibility of being able to borrow money as required, a HELOC may be a good option.

This type of second mortgage has two time periods: the draw period and the payback term. You can withdraw as much money as you need throughout the draw period, which can run anywhere from 5 to 10 years, up to your maximum. You'll just have to pay interest on the money you borrow each month.

The repayment term (usually 10–20 years) will commence once the draw period has expired, and you will be obliged to repay the principle as well as any interest on the amount borrowed. You will not be able to borrow money from your HELOC during the repayment period.

A HELOC may be used for any purpose, but it's especially handy if you need to spread out a large financial obligation over time, such as college tuition or a total house renovation.

What Factors Influence My Second Mortgage Application Approval

All banks, building societies, and other mortgage providers will consider your current mortgage arrangement to be payment for your principal residence.

If you apply for a loan and buy another house, your mortgage provider will consider it your second home.

Because you already have a mortgage, your application will be treated as a second home mortgage, regardless of whether you intend to live in the second property or rent it out.

Because not all mortgage firms provide second mortgages, you should first speak with your current lender to determine whether they would supply you with one. If you apply for a second home mortgage with any of the lenders, you'll almost certainly be confronted with more stringent restrictions.

In general, a larger down payment is required for a second home mortgage than was allowed for your first. Furthermore, second-home mortgage interest rates are likely to be higher than regular mortgage interest rates.

What Is The Process For Getting A Second Mortgage

You'll go through all of the same financial checks as usual, but the mortgage lender will be more hesitant to lend to you because making two monthly mortgage payments will be more expensive.

Banks are more ready to lend to you if you have some sort of collateral to protect them in the event that you default on your loan.

Property is usually considered the principal form of security, which means that if you default on your second charge mortgage or secured loan, the bank may repossess your current house.

What To Consider About When Getting A Second Mortgage

There's no denying that a second mortgage offers several advantages. However, just like any other financial product, there are some disadvantages to be aware of before investing.

When you take out a second mortgage, you are putting your home on the line since your lender will foreclose on your home if you stop making payments. A second mortgage can also be expensive when interest, closing costs, and fees are included in. Additionally, it may put a strain on your financially. If you lose your job or have an unforeseen medical emergency, you may find yourself in serious debt.

While these risks aren't sufficient reasons to avoid a second mortgage, they should be considered.

How To Get A Second Mortgage

Take a close look at your financial situation: Once you know your credit score, calculate your DTI and determine if you can afford to take on extra debt.

To figure out how much equity you have in your property, do the following: Subtract the amount owing on your mortgage from the property's current market value.

Determine the type of second mortgage you require: Are you looking for a home equity line of credit (HELOC) or a home equity loan? The response will be determined by whether you desire a lump sum payment or a revolving line of credit.

Take some time to browse around: Do some research to find lenders who provide your chosen second mortgage. Banks, credit unions, and online lenders are all good places to look for loans.

Speak with a Home Loan Expert: Once you've found an alternative or two that suits your budget and criteria, it's a good idea to contact a Home Loan Expert. They'll be able to answer any of your questions and ensure that you're making the finest decision possible.

Pros And Cons Of Second Mortgages

Pros Of A Second Mortgage

Second mortgages can result in significant debt. A second mortgage from some lenders may allow you to borrow up to 90% of the value of your home. This implies that a second mortgage allows you to borrow more money than other types of loans, especially if you've been paying on your first mortgage for a long time.

The interest rates on credit cards are greater than those on second mortgages. Secured debt, such as second mortgages, is defined as debt that is backed by something (your home). Because the lender is less likely to lose money, second mortgages have lower interest rates than credit cards.

There are no limitations on the amount of money that can be spent. There are no limits or constraints on how you may use your second mortgage funds. When it comes to planning a wedding or paying off college debt, the sky is the limit.

Cons Of A Second Mortgage

Second mortgages have higher interest rates. Second mortgage interest rates are frequently higher than refinancing interest rates. This is because lenders are less interested in your home than your primary lender.

Your finances may be strained as a result of a second mortgage. When you get a second mortgage, you agree to make two monthly payments: one to your primary lender and one to your secondary lender. This might put a strain on your family's finances, especially if you're already scraping by.

Is A Second Mortgage Right For You

Second mortgages are debts that are secured by a portion of the equity in your house that has been paid off. When you take out a second mortgage, your lender may offer you a single lump-sum home equity loan or a revolving line of home equity credit. Your lender has the power to repossess your home if you fail on your second mortgage.

Refinances differ from second mortgages in that they add a new monthly payment to your budget instead of changing the terms of your current loan. Second mortgages are more difficult to get than cash-out refinances since the lender has a smaller claim on the property than the primary lender. Second mortgages are frequently utilised to finance large, one-time expenses like credit card debt consolidation or college tuition.

Consider all of your options before applying for a second mortgage, and be sure you can afford the payments.

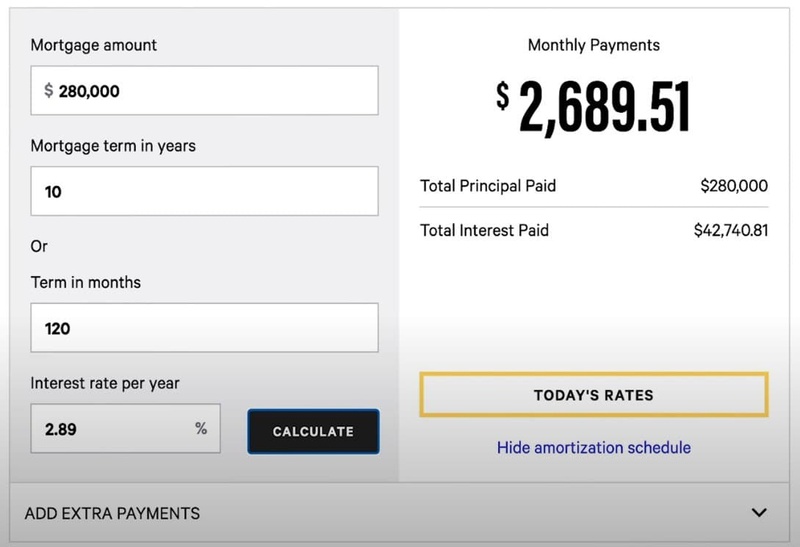

How To Pay Off My Mortgage Faster

Because mortgages are frequently large loans that endure for decades or more, paying off a mortgage early may save you tens of thousands of dollars in interest. Not to mention the comfort of not having to make a mortgage payment on a monthly basis.

Because mortgages are frequently large loans that endure for decades or more, paying off a mortgage early may save you tens of thousands of dollars in interest. Not to mention the comfort of not having to make a mortgage payment on a monthly basis.

When you send your monthly check to your mortgage lender, the payment is split between principal and interest. Early in the loan, a major portion of the payment is devoted to interest. As time goes on, a higher amount of the payment goes toward the principal. This is referred to as amortisation, and it allows the lender to reclaim a larger portion of their initial investment in the first few years. Extra principle payments are the key to paying off your home sooner.

Before you decide to pay off your mortgage early, ask yourself the following questions:

Is my emergency fund large enough to cover at least six months' worth of expenses? Are my retirement funds and other important financial goals on track? Is there any high-interest debt on my account, such as credit cards, and if so, how much is it? Paying off your mortgage early may be a sensible financial option if you can answer yes to all three questions. Remember that some lenders charge a prepayment penalty; if yours does, make sure to include that in as well.

6 Ways To Pay Off Your Mortgage Early

Refinance To A Shorter Term

Although lenders occasionally provide shorter lending lengths, the 30-year mortgage is the most typical. Although a 15-year loan is the most common, many lenders also offer 10-, 20-, and 25-year loans.

Shorter repayment terms result in higher monthly payments but cheaper interest throughout the life of the loan. Take a look at the difference between a 20-year and a 30-year job term.

Interest rates for 20-year mortgages are often lower than those on 30-year mortgages. Rates for 20-year mortgages are usually one eighth (0.125%) to a quarter percent (0.25%) lower than rates on 10-year mortgages.

Assume you're borrowing $250,000 over 30 years at a 3.75 percent interest rate. The total amount you'd pay each month in principal and interest would be around $1,150. If you had the same loan amount but a 20-year term at 3.625 percent, your monthly payment would be $1,450. You'd have to pay a few hundred dollars extra every month, but you'd be debt-free after ten years.

What is the most important aspect? You would save about $65,000 in interest if you kept that 20-year mortgage until it was paid off.

Another benefit of refinancing to a shorter term is that you won't have to begin making payments again for another 30 years. For many homeowners who are far into their first mortgage term, starting over with another 30 years of interest may not make sense.

In contrast, a 15-year refinance allows you to lock in a low interest rate and a shorter loan term, helping you to pay off your mortgage faster. Remember that the shorter the loan term, the higher your monthly payments will be.

Make Additional Payments

The first option is to split your monthly mortgage payment in half and pay it every two months. Instead of the customary 12, you'll end up paying the equivalent of 13 months' worth of mortgage payments in a year. This method may be straightforward for some homeowners because it is barely evident in the monthly budget.

You should check with your lender to determine if biweekly payments are accepted; some do not. In this case, it's up to you to set aside those biweekly instalments, but you'll pay them all at once each month. The benefit of the extra yearly payment is still available, but without the convenience of a monthly payment split from the lender.

The second alternative is to pay extra each month in order to pay down the principle faster, potentially saving you tens of thousands of dollars over the life of the loan.

Assume you had a $250,000 mortgage with a 4% interest rate over 30 years. If you add an extra $100 monthly payment to the principal amount of your loan, you may save four years and $27,957 on your mortgage.

Because it does not bound you to a payment, this is a better option than refinancing. If you are unable to increase your monthly mortgage payment due to unforeseen circumstances, you will not be penalised.

If you choose this option, double-check with your lender that your payments will go toward the principal rather than interest. Make sure the lender understands that the extra payment isn't for the next month's mortgage.

Make An Additional Mortgage Payment Each Year

By making an extra mortgage payment each year, you may significantly reduce the term of your debt. Paying 1/12 more each month is the most cost-effective way. For example, if you pay $975 every month on a $900 mortgage, you'll have paid the equivalent of an extra payment by the end of the year.

Many homeowners choose to make an extra payment each year to pay off their mortgage faster. One of the simplest ways to make an extra payment each year is to pay half of your mortgage payment every other week instead of the whole amount once a month. "Biweekly payments" is the term for this.

When you pay bi-weekly instead of monthly, you wind up with an extra payment per year. However, you cannot begin making payments every two weeks. Your loan servicer may be baffled by your infrequent and partial payments. Speak with your loan servicer first to set up this plan.

You can also pay the 13th payment at the end of the year. However, this strategy demands the payment of a considerable sum of money. Some homeowners combine their extra payment with their tax return or a yearly bonus at work.

Making an extra payment each year, whichever you decide to do it, is an excellent way to pay off a mortgage early.

If you borrowed $200,000 for 30 years at 4.5 percent interest, your monthly principle and interest payment would be around $1,000. If you paid an extra $1,000 every year, your 30-year term might be cut by 412 years. You'll save about $28,500 in interest if you finish the loan. There are other advantages to paying off your mortgage quickly.

If you reduce your payment, you'll be able to stop paying private mortgage insurance (PMI) instalments sooner. PMI may be eliminated if you pay down 20% of the original loan amount on a conventional loan.

Recast Your Mortgage

In contrast to refinancing, recasting a mortgage allows you to keep your present debt. You just make a one-time principal payment, and the bank will adjust your repayment plan to reflect the new amount. As a result, the loan term will be shortened.

The expenses of recasting are significantly lower than those of refinancing. Recasting a mortgage normally only costs a few hundred dollars. Closing costs for a refinance, on the other hand, are frequently in the thousands of dollars.

Furthermore, if you have a low interest rate on your mortgage now, you may be able to keep it if you refinance. If your interest rate is higher, refinancing may be a better option. If you prefer this alternative, discuss it with your lender or servicer. Some firms will not allow you to refinance your mortgage.

Refinance Your Mortgage

Refinancing your mortgage to pay it off sooner makes sense if you can get a lower interest rate. Remember that refinancing comes with fees, so be sure the savings outweigh the costs.

Refinancing to a shorter-term loan, such as from a 30-year to a 15-year mortgage, can help you save money on interest while also getting you closer to paying off your debt sooner. Using Bankrate's calculator, you can compare payments and total interest over 30-year and 15-year periods.

Make Lump-Sum Payments To Your Principal

When you can, make lump-sum payments to your principal instead of recasting. Homeowners who receive large bonuses, inherit money, or sell valuable items may choose to utilise the extra earnings to pay down their mortgage.

Due to the fact that VA and FHA loans are not recastable, lump-sum payments may be the best alternative for borrowers. You'll also avoid paying the lender's recasting fee.

When extra monies should be paid to the principal, certain mortgage servicers need you to mention this. Check with your servicer if you have any questions about how lump-sum payments will be used.

Round Up Your Mortgage Payments

Another way to substantially reduce the term of your mortgage is to round up. When calculating your mortgage payment, round up to the next highest $100 figure. Pay $800 instead of $743. Alternatively, you might spend $900 instead of $860.

Introduction to Mortgage Loans | Housing | Finance & Capital Markets | Khan Academy

Pros And Cons Of Paying Off Your Mortgage Early

In the long term, paying off your mortgage early may save you money. You'll have more money to play with each month if you cease making payments, and you'll save money on interest.

On the other hand, making extra mortgage payments isn't for everyone. You could be better off focusing on other bills or investing the money instead. Below are the advantages and disadvantages of paying off your mortgage early.

4 Benefits Of Paying Off Your Mortgage Early

You may save money without having to pay interest. Interest is deducted from your monthly mortgage payment, so the fewer payments you make, the less interest you'll pay. Paying off your mortgage early might save you tens of thousands of dollars. (Just make sure to inform your lender that any additional payments will go toward the principal rather than interest.)

There will be no additional payments made on a monthly basis. By lowering your monthly mortgage payments, you may use that money toward other things. You may invest the extra money or use it to pay for your child's college tuition, for example.

You are the only one who owns the house. If you experience a financial setback, it's likely that you won't be able to make your monthly mortgage payments. Your house may be repossessed if you fall behind on your payments. When you own your house outright, there is no chance of losing it.

Mindfulness. You could simply enjoy the idea of not having to worry about a mortgage. The freedom that comes with not having to pay a mortgage is an excellent motivator.

4 Drawbacks Of Paying Off Your Mortgage Early

Investing helps you to increase your income. At this time, the typical mortgage interest rate is around 3%. The average stock market return over a ten-year period is around 9%. So, if you choose to pay off your mortgage 10 years early vs investing in the stock market for 10 years, you'll nearly surely be better off investing.

Mortgages have prepayment penalties. A mortgage prepayment penalty is a fee you must pay to your lender if you sell, refinance, or pay off your mortgage within a certain amount of time after the initial loan closes - usually three to five years. This fee isn't charged by all lenders, and you shouldn't have to worry about it if you're paying off your mortgage in less than five years. You should, however, always speak with your lender beforehand.

The mortgage interest tax deduction has been phased down. If you own a property, you can deduct the amount you pay in mortgage interest from your taxable income. You'll lose this advantage if you pay off your mortgage early.

Your credit score will suffer as a result. A variety of factors influence your credit score, one of which is the mix of credit types you have. You could have a credit card, a car loan, and a mortgage, for example. If you delete one type of credit, your credit score will suffer. This should be a simple adjustment, but it's worth considering.

Is It Possible For You To Pay Off Your Mortgage Early

In most cases, you may pay off your mortgage early without penalty, but there are a few things to consider before.

To begin, find out if your mortgage has a prepayment penalty by contacting your loan servicer. If it does, you'll have to pay a penalty if you pay off your loan early. This might have an influence on whether or not you can afford to pay off your mortgage early.

Second, look into any restrictions on how and when you may make further payments. Some loans include terms that encourage you to stay on track with your payments, and it's vital to make sure that any extra payments go toward the principle rather than interest.

Top 10 Questions To Ask Yourself Before Paying Off Your Mortgage Early

How Would You Put The Money You'd Save On Monthly Payments To Good Use

If you're paying off your mortgage early to free up extra monthly cash flow, have a strategy for how you'll spend it. It could be a wise use of money to invest $900 per month instead of paying your $900 mortgage payment.

It's ultimately up to you to determine how you'll use the extra cash. If you can't think of what you want to do with the money or if you'd spend it on frivolous stuff, paying off your mortgage early may not be the best financial move. Before you pay off your mortgage early, ask yourself these ten questions.

Is Your Retirement Strategy On Track

Before paying off a mortgage, spend some time evaluating the viability of your retirement plan, either with the help of a financial consultant, online calculators, or both. Yes, paying off a mortgage rather than investing in the stock market will result in fewer liquid retirement funds. Reduced household expenses may allow you to enhance future retirement-plan contributions; a paid-off home also means lower in-retirement costs, allowing you to cut your expected withdrawal rate.

The time horizon has a significant impact on the decision-making process here. Those with more years until retirement can benefit more from the compounding benefits of investment assets they put to work today, whereas those who are nearing or in retirement and plan to start drawing on their investment assets may not get as much bang for their buck by diverting additional assets to their investment accounts.

What Other Debts Do You Have

Knowing your mortgage rate is beneficial for the first time since it allows you to compare the rates you're paying on all of your loans on a like-for-like basis.

Pay off your most expensive loans first, according to a basic rule of thumb. I know it seems dumb, but you'd be surprised at how many people don't do it correctly.

Many people make the mistake of believing that the amount owed is what makes the loan expensive, rather than the interest rate. The danger of debt accumulation increases as the interest rate rises, making repayment more difficult over time.

If you have credit cards, store cards, personal loans, or other high-interest debt, look into the interest rates you're paying. If they exceed your mortgage, you should pay them off first before thinking about overpaying your mortgage.

What Is Your Mortgage's Interest Rate

You'll need to know your current interest rate if you're thinking about paying off your mortgage early. Why? Understanding your rate, as we'll see in the next sections, will provide you the knowledge you need to decide whether or not overpaying is the best decision for you.

It's all too easy to hear a friend say they saved thousands of dollars in interest payments by shortening their mortgage term, and believe you should do the same. However, you should do the numbers yourself to ensure that paying off your mortgage early is the right option for you, and having your current mortgage rate accessible is the first step.

How Consistent Is Your Income

Everyone should have an emergency fund, but some people may need to increase their amounts to account for their income's volatility. It's vital to think about how stable your income is. While we all have an element of the unknown in our lives, those who are self-employed or run a business have a far greater need for this piece of the puzzle.

It's also a bad idea to think about your income's consistency in a subjective approach. It's easy to get this wrong, especially if you're supplementing with debt from credit cards or other sources, so be absolutely honest with yourself and calculate your average salaries over the previous year to get a reasonable approximation of your monthly income.

Once you have it, you may begin to consider how things might change in the next months and years. Do you have any contingency plans in place in the event that your most significant client goes bankrupt? Is it true that your job is completely risk-free? Are there going to be any job cuts?

While none of us has a crystal ball, we can often plan better with a little forethought, and this examination of our circumstances may offer a clear 'no' to whether or not overpaying your mortgage is a good idea, so it's worth the time and effort.

What Is Your Investment Portfolio Like And Where Do You Keep It

Similarly, the mix of your financial assets and where you keep them are important considerations. In the coming decade, it's reasonable to anticipate equities to produce 4% to 5% real (inflation-adjusted) returns, giving an equity-heavy portfolio a good chance of surpassing today's ultra-low mortgage rates.

The case for investing in the market rather than prepaying the mortgage gets considerably stronger if you maintain your assets in a tax-sheltered vehicle and/or receive matching funds on your contributions. Portfolios with a high proportion of cash and fixed-income assets, especially those that are fully taxed year after year, are less likely to outperform mortgage interest rates.

How Much Money Can You Save By Taking Advantage Of Your Mortgage Interest Deduction

Many homeowners feel that retaining their mortgages is a smart option since interest payments may be deducted from their taxes. However, as previously indicated, because interest payments are front-loaded on home loans, this deduction lowers with time.

People who have been able to pay off a mortgage over time may be overestimating the amount of taxes they save, and itemizing deductions may not save them nearly as much as the standard deduction.

Is It Possible That Inflation May Help You In Paying Down Your Mortgage

Here's something you might not know, but it's critical. Only 20 years ago, a property could be acquired for $5000 [compare that to a ridiculously pricey bottle of champagne in Mayfair now, which costs $35,000]. This means that the money you spend on your repayment mortgage will be worth significantly less than what you paid for it over the period of 25 years.

Don't be concerned about inflation; the money you've been paying will be worth less in 25 years than it is today ($250K will be worth less in 25 years than it is now). Pay down your mortgage if you're willing to pay a sum now that will be worth a fraction of what it will be in 25 years.

Will The Current Mortgage Allow You To Pay Down The Loan Early

Credit cards, for example, should always be paid off first because the interest rates are generally higher. But, assuming you don't have any or have already paid them off, do you have any plans to pay off the loan early, and if so, how much earlier? If you have a fixed rate loan and are paying down a big chunk of your debt, you'll normally have a limit on how much you may pay, usually 10% of the entire loan amount.

You'll almost likely have to pay an Early Repayment Fee if you don't pay on time (ERC). Once the promotional rate period ends, there are normally no restrictions, but it's a good idea to contact the lender or check your mortgage offer for more details.

Another thing to bear in mind is that interest will make up the majority of your repayments for the first few years (depending on how long you've had your mortgage). This means that your payments will be mostly top-heavy, and if you opt to pay off your mortgage with overpayments, the amount you owe will not have lowered significantly.

Could You Receive A Greater Return On Your Investment Elsewhere

If the cost of financing is exceptionally low, there is an opportunity cost of cash to consider for leveraging money for property investment, so paying down your mortgage may or may not be the most cost-effective use of your money.

Consider if you'd rather save $200 or create $500 in monthly net cashflow by renting a home and benefiting from capital development. You have several substantial investing options if you can borrow money at 2%+ and generate a 15%+ return on capital invested in a normal buy-to-let.

Final Words

The purchase of a home is the single largest personal investment that most people will ever make. Before taking on such a hefty debt, take the time to run the figures. After you've done the numbers, consider your current situation and how you want to live in the future - not just now, but in a decade or two. Consider not just how much it would cost to buy a new home, but also how your future mortgage payments will effect your life and budget. Then, to get real-world information on the sorts of discounts you could be eligible for, request loan estimates from a variety of lenders for the type of property you want to buy.

A mortgage is an important tool for buying a house since it allows you to become a homeowner without putting down a large down payment. When you have a mortgage, however, you must understand the structure of your payments, which include not only the principle (amount borrowed), but also interest, taxes, and insurance. It calculates how long it will take you to pay off your mortgage and, as a result, how much money you will need to buy a property.