What You Need to Know About Mortgage Calculators In 2022

While borrowing enough money to make your mortgage payments is essential, you should not go overboard and end up unable to afford your home. It's possible that using our mortgageaffordability calculatorwould be beneficial to you.

Getting a mortgage to buy a house is one of the most important financial decisions that most people will ever make. In addition to the amount of money a bank is ready to lend you, a number of other factors also have a role in how much you may borrow. Personal preferences and priorities must be taken into consideration as well as your financial status.

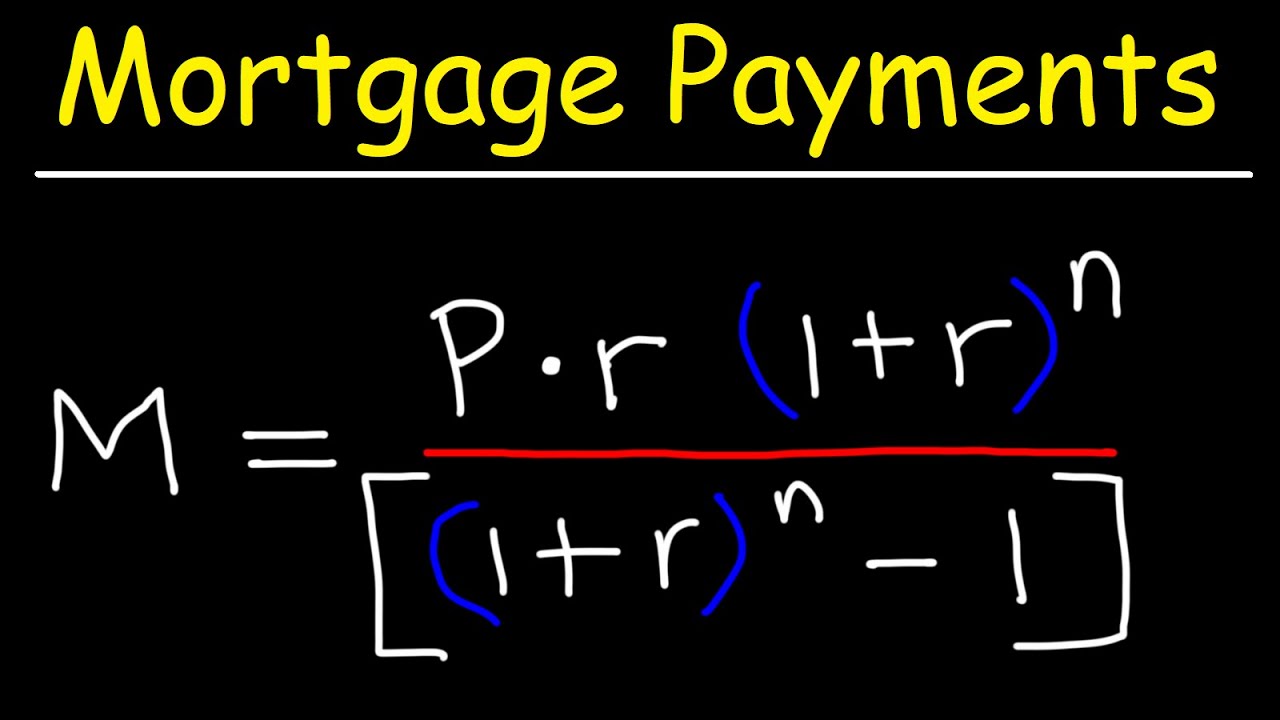

How To Calculate Your Monthly Mortgage Payment Given The Principal, Interest Rate, & Loan Period

If I Make This Much Money, How Much House Can I Afford?

When you are pre-approved for a mortgage, the lender will tell you how much money you may be able to borrow. Lenders look at more than just your salary and credit score when deciding how much money you may borrow.

Consider carefully your financial situation at the same time to see how much you can really afford. There are a few rules that financial advisors follow, but it's up to you to decide whether you're okay with the idea of taking on debt.

Financially speaking, the majority of people can comfortably finance a home that costs around 2.5-3 times their annual gross income. If you make $100,000 per year, you're only eligible for a mortgage of between $200,000 and $250,000, according to this computation. It's important to keep in mind that this is only an estimate and should not be taken too seriously.

Finally, there are a number of additional things to consider while looking for a new place to call home. The first step is to find out how much money your lender thinks you can afford (and how it arrived at that estimation). If you want to remain in your house for a lengthy amount of time, you should also reflect on your own lifestyle and decide what types of consumption you are ready to give up or not include in your home.

How Much Can I Afford To Borrow?

There are several factors that go into determining the amount of money you may borrow for a mortgage, including your salary and any other regular commitments, such school loans or credit card bills.

These factors are taken into consideration by mortgage lenders when determining how much money they are willing to loan you. Most mortgage providers will guarantee that you will be able to repay the loan even if interest rates increase. This is an important consideration.

Unlike a remortgage or a second charge mortgage, a second house mortgage may only be used to buy a second home. People who wish to acquire a second home as an investment or a holiday property may utilize second mortgages.

Some people may have finished paying off their first mortgage and feel ready to take on a second one because of this. Paying down a second mortgage may be a significant load on your finances, thus the rules are more severe than with a first mortgage.

Ways To Get My Mortgage Paid Off Faster

Because mortgages may continue for decades or more, paying off a mortgage early can save you tens of thousands of dollars in interest. Not to mention the stress reduction that comes with not having to make a mortgage payment each month.

When you make a monthly mortgage payment to your lender, the amount is split between principal and interest. Early in the loan, a large portion of the payment is earmarked for interest. The principal gets a bigger chunk of the payment as time goes on. For the lender, this is known as amortization, and it allows them to recover more of their investment in the first few years. The secret to paying off your mortgage faster is to make additional payments on the principle.

Before you decide to pay off your mortgage early, ask yourself the following questions:

- There must have at least six months' worth of spending in my emergency fund.

- Am I on pace to meet my financial goals, such as retirement savings and other long-term goals?

- Are there any high-interest debts that I hold, such as credit cards?

All three of these questions must be answered in order for you to consider paying off your mortgage early. Pay attention to if your lender has a penalty for early repayment; if so, include that in as well.

Summary

One of the biggest financial commitments that the majority of people will ever make is the purchase of a primary residence. Don't take on so much money without doing the math beforehand. Think about where you are today and where you want to go in ten or twenty years after you've crunched the numbers. Before you purchase a new home, consider not just the purchase price but also the impact that future mortgage payments will have on your daily routine and financial situation.